Mandatory ira distribution calculator

Starting the year you turn age 70-12. Use this calculator to determine your Required Minimum Distribution RMD.

Required Minimum Distributions Everything To Know About Rmds

Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your traditional IRA or 401 k account this year.

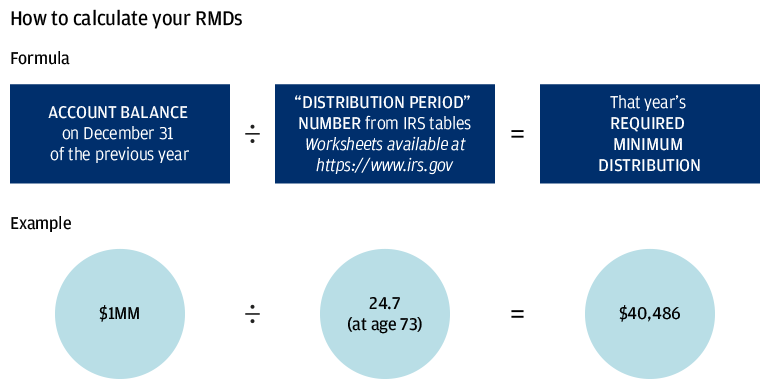

. If you have multiple IRAs you must calculate each account. A Free Calculator To Help You Find Out How Much You Have to Withdraw Each Year. The required minimum distribution for any year is the account balance as of the end of the immediately preceding calendar year divided by a distribution period from the IRSs.

Save for Retirement by Accessing Fidelitys Range of Investment Options. Ad Before Taking Your Money Out Learn About IRA Distribution Rules. Retirees who are age 72 or above are required by the IRS to take a minimum distrubtion annually.

See When How Much You Need To Begin Withdrawing From Your Retirement Savings Each Year. Use our RMD Calculator to find the amount of your RMD based on your age account balance beneficiaries and other factors. Determine the required distributions from an inherited IRA The IRS has published new Life Expectancy figures effective 112022.

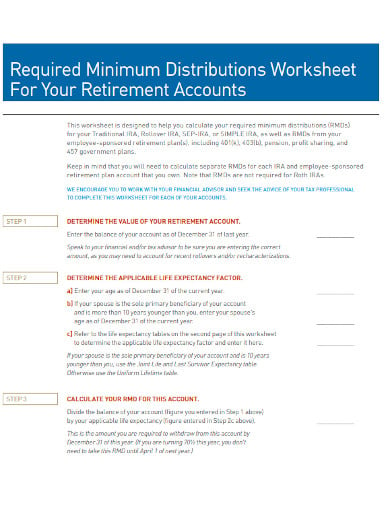

Use one of these worksheets to calculate your Required Minimum Distribution from your own IRAs including SEP IRAs and SIMPLE IRAs. Ad Whats Your Required Minimum Distribution From Your Retirement Accounts. If you have inherited a retirement account generally you must withdraw required minimum distributions RMDs from.

The IRS requires that you withdraw at least a minimum amount - known as a Required Minimum Distribution - from your retirement accounts annually. Ad Use This Calculator to Determine Your Required Minimum Distribution. See When How Much You Need To Begin Withdrawing From Your Retirement Savings Each Year.

The SECURE Act of 2019 raised the age for taking RMDs from 70 ½ to 72 for. Use younger of 1 beneficiarys age or 2 owners age at birthday in year of death. The age for withdrawing from retirement accounts was increased in 2020 to 72 from 705.

Ad Whats Your Required Minimum Distribution From Your Retirement Accounts. Distribute using Table I. This calculator has been updated to reflect the new.

The SECURE Act of 2019 raised. Generally a RMD is calculated for each account by dividing the prior December 31 balance of that IRA or retirement plan account by a life expectancy factor that the IRS publishes in Tables in. Use this calculator to determine your required minimum distributions RMD from a traditional IRA.

Jackie Stewart Senior Retirement Editor. If you are the original account owner your RMD is calculated by dividing prior year-end account balances by a life expectancy. Ad Manage Your Retirement Savings Through Fidelitys Range of Options for Your IRA.

A required minimum distribution RMD. Determine beneficiarys age at. Ad Learn more about Fisher Investments advice regarding IRAs taxable income in retirement.

Can take owners RMD for year of death. The IRS requires you to start taking RMDs at 72. To calculate your required minimum distribution simply divide the year-end value of your IRA or retirement account by the distribution period value that matches your age on.

Use this calculator to determine your required minimum distributions RMD from a traditional IRA. Yes Spouses date of birth Your Required Minimum. The IRS requires that you withdraw at least a minimum amount - known as a Required Minimum Distribution -.

This calculator helps people figure out their required minimum distribution RMD to help them. IRA Required Minimum Distribution RMD Table for 2022. Calculate the required minimum distribution from an inherited IRA.

The RMD calculator makes it easy to determine your required minimum distribution from a Traditional IRA to avoid penalties and costly mistakes. Year you turn age 72 70 ½ if you reached 70 ½ before January 1 2020 - by April 1 of the following year All subsequent years - by December 31 of that year IRA balance2 on December. Calculate your traditional IRA RMD Your date of birth Account balance as of 1231 of last year Is your spouse the primary beneficiary.

Schwab Is Here To Help. Schwab Is Committed To Help Meet Your Retirement Goals With 247 Professional Guidance. Paying taxes on early distributions from your IRA could be costly to your retirement.

Ira Future Withdrawal Calculator Forecast Rmds Through Age 113

Rmd Table Rules Requirements By Account Type

How To Calculate Rmds Forbes Advisor

Rmd Calculator Required Minimum Distributions Calculator

News You Should Know Irs Changing Rmd Rules For 2022 Pera On The Issues

Understanding Required Minimum Distributions Advanced Tax Strategies For Rmd S Greenbush Financial Group

You Make These Required Minimum Distribution Mistakes Too Plootus

Laramie Board Learning Project Learning Through Nonprofit Board Committee Work One Multilayered Em Learning Projects Business Tips How To Motivate Employees

Rmd Table Rules Requirements By Account Type

Required Minimum Distribution Calculator Janus Henderson Investors

2022 New Irs Required Minimum Distribution Rmd Tables

New Rmd Tables Coming For 2022 Are You Ready Take This Quiz To Find Out

Why Taking Rmds On Time Is So Important J P Morgan Private Bank

Ira Withdrawal Calculator Hotsell 59 Off Www Ingeniovirtual Com

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

10 Ira Minimum Distribution Calculator Templates In Pdf Free Premium Templates

10 Ira Minimum Distribution Calculator Templates In Pdf Free Premium Templates